What can I expect from you?

LLC or S Corp? Get clarity from a small business advisor

Talk through your structure with a Certified Financial Planner™ — and we’ll help set up the S Corp if it’s the right move.

We help you get the structure and strategy right

How it works

1

We understand your situation.

We cover everything about your business and also about your personal finances. Because both matter.

2

Get a comprehensive plan.

We’ll dive deeper on your finances to spot optimizations and surface recommendations. If an S Corp makes sense, we’ll help you file the election and update your tax structure.

3

We're here for you

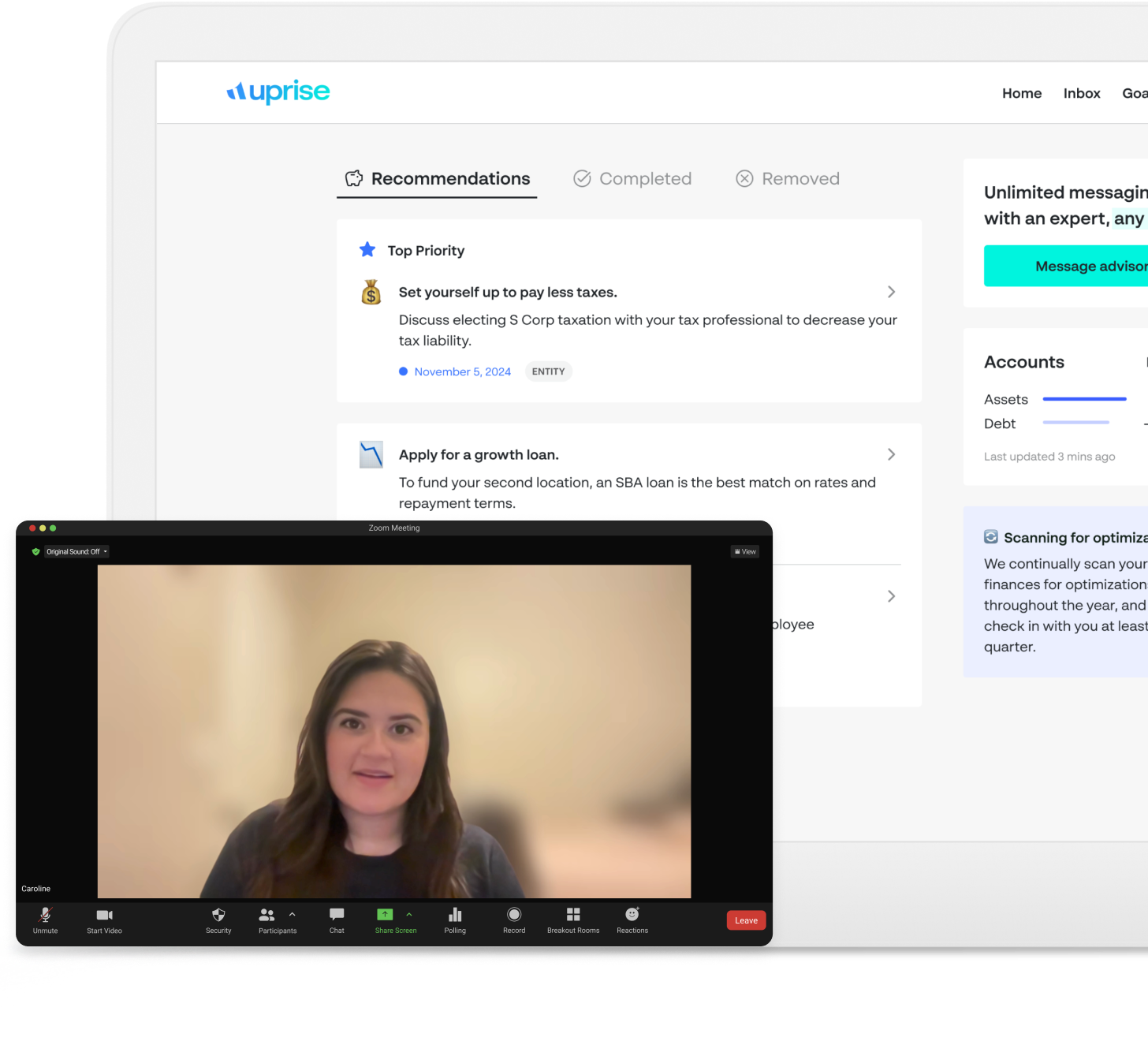

Meet your advisor over video and message them any time, as much as you want.

Traditional financial advisors:

Don’t have small business expertise

Don’t understand entity structure or tax planning

Can cost tens of thousands of dollars per year

Only available to high net-worth individuals

Are low-tech

Are focused on AUM

Are limited to their own products

Financial advisory, as unique as your small business

Our Certified Financial Planners™ specialize in the unique challenges small business owners face with expertise across diverse industries.

Freelancers and agency owners

Creators

Private practices and healthcare providers

Real estate agents and property managers

Restaurant owners

Trusted and loved by thousands

Opened my eyes to new ways for financial planning - bridged the gap between S-Corp structures and retirement.

Nick, user researcherYou’ve given me more tax advice than my tax guys have in 3 years.

Samuel, consultantI swear my jaw dropped every page I went to. I was truly amazed. Every recommendation in my plan was SO personalized!

Grace, content creatorYou don’t need to pay more for the best financial advice

Essential

Comprehensive, personalized financial planning for your business and for you

Unlimited messaging with your advisor

Continuous monitoring of your finances for new opportunities

Unbiased advice personalized to your business and your personal finances

$150/month

Premium

Everything included in Essential, plus:

45-minute introductory video call with your Uprise Certified Financial Planner (CFP®) before drafting of the financial plan

45-minute video call to review your personalized financial plan

Additional calls as needed

$267/month

Complete

Everything included in Premium, plus:

S Corp election handled for you

Business and personal tax filing (LLC or S Corp)

Includes Schedule C, Form 1120S, and state returns

Integrated tax services provided by a licensed tax partner

$417/month

Frequently asked questions

Do you serve people outside the US?

How are you able to make this so affordable?

Who is this for?

How does the money-back guarantee work?

Stop guessing about your business structure.

Talk to an advisor who knows S Corps and LLCs.